|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

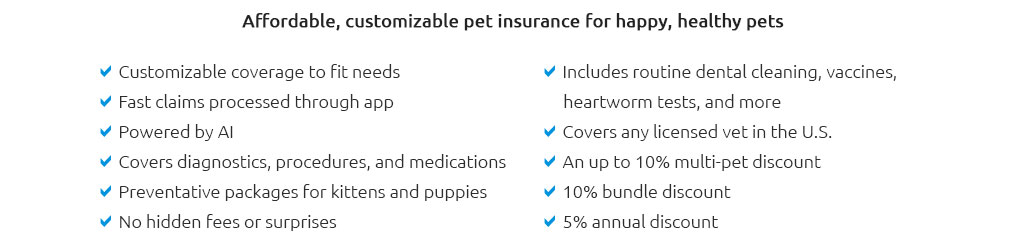

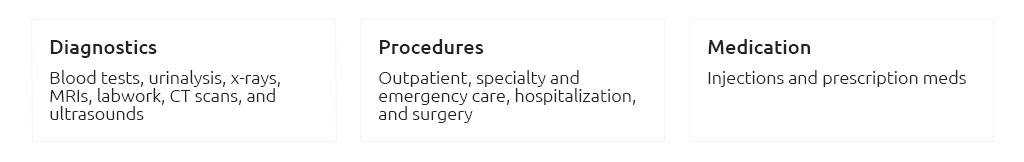

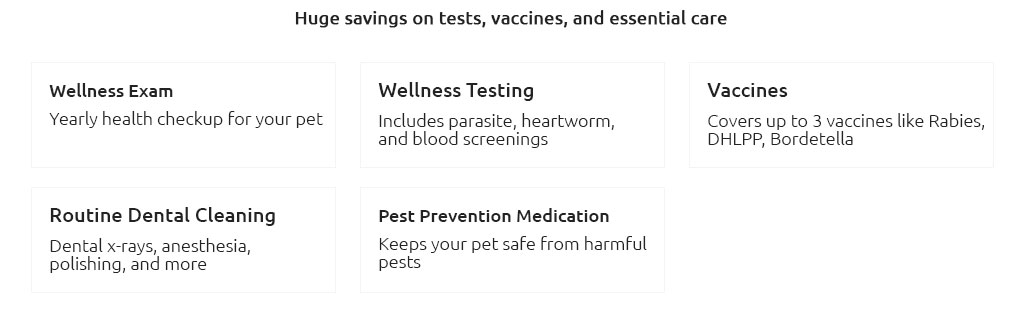

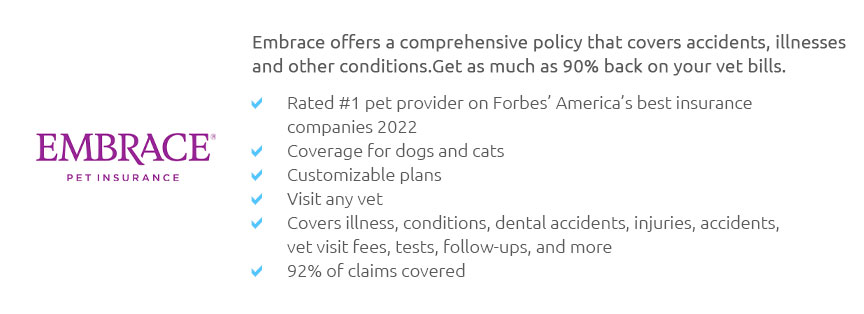

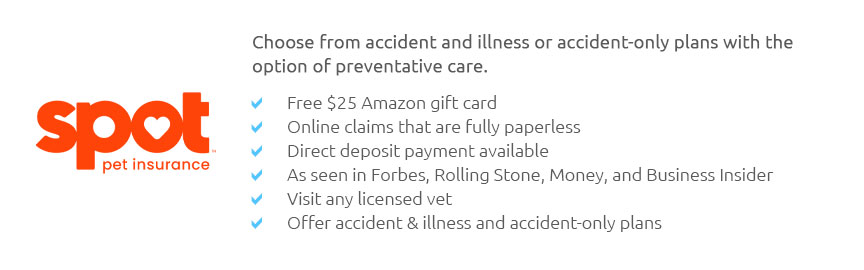

Pet Insurance for Cats: A Comprehensive ComparisonAs a cat owner, one of the most significant decisions you'll make revolves around the health and well-being of your furry friend. With the increasing costs of veterinary care, pet insurance is becoming a necessity rather than a luxury. But how do you choose the right plan for your feline companion? Let's explore the intricacies of pet insurance for cats, comparing options and addressing common concerns to help you make an informed decision. First and foremost, it's essential to understand what pet insurance covers. Generally, policies include coverage for accidents, illnesses, and sometimes routine care. However, the extent of coverage can vary significantly between providers. Some plans offer comprehensive coverage that includes everything from minor illnesses to major surgeries, while others may only cover accidents or specific conditions. It's crucial to thoroughly read the terms of any policy to ensure it aligns with your needs. Cost is often a primary consideration for pet owners. While it's tempting to opt for the cheapest plan, it's important to balance cost with coverage. Typically, policies with lower premiums have higher deductibles or co-pays, meaning you'll pay more out-of-pocket when you need to make a claim. On the other hand, higher premium plans often have lower deductibles and more extensive coverage. When comparing costs, consider your cat's age, breed, and health history, as these factors can influence premiums. Another common concern is exclusions. Most pet insurance plans have exclusions, such as pre-existing conditions, hereditary issues, or certain breed-specific conditions. If your cat has a known health issue, it might not be covered, or you might face higher premiums. It's wise to check the policy details carefully for any exclusions that could affect your cat. When evaluating different insurance options, consider the provider's reputation. Research customer reviews and ratings to gauge the insurer's reliability in processing claims and providing customer service. A company with a solid reputation is more likely to offer a smooth claims process and support when you need it most. Additionally, some cat owners worry about flexibility in choosing veterinarians. Most insurance plans allow you to visit any licensed vet, but it's worth confirming this detail. A plan that limits you to a specific network may not be ideal if you have a trusted vet you wish to continue seeing. Finally, many pet owners question the value of pet insurance. While it might seem like an unnecessary expense, it can be a financial lifesaver in emergencies. Consider the peace of mind that comes with knowing you're prepared for unforeseen medical expenses. If you're still uncertain, calculate the potential costs of common procedures and compare them to your insurance premiums to weigh the potential savings. In conclusion, choosing the right pet insurance for your cat requires careful consideration of coverage, cost, exclusions, provider reputation, and flexibility. By taking the time to compare different plans and addressing your specific concerns, you can ensure your feline friend receives the best care without breaking the bank. Ultimately, the right insurance plan will provide you with peace of mind, knowing that your beloved pet is protected. https://www.petinsurancequotes.com/

Find the best pet insurance for dogs and cats. Compare coverage, cost, wellness plans, and more from top insurers. Get a free quote for your pet today. https://www.comparethemarket.com/pet-insurance/cat-insurance/

Like a life insurance package for your cat. One of the easiest ways to get a pet insurance policy that covers all your cat's needs is to compare cat insurance ... https://www.progressive.com/pet-insurance/

Pets Best offers two tiers of wellness plans that you can add on to your accident and illness pet insurance plan (known as the BestBenefit plan). Both of these ...

|